bunq Review

Company Information

bunq is an international mobile bank that serves the European Economic Area (EEA) and was created by Ali Niknam in 2015. This Amsterdam-based mobile bank is a borderless, branchless bank that is permitted and insured by the Dutch (Holland) Central Bank.

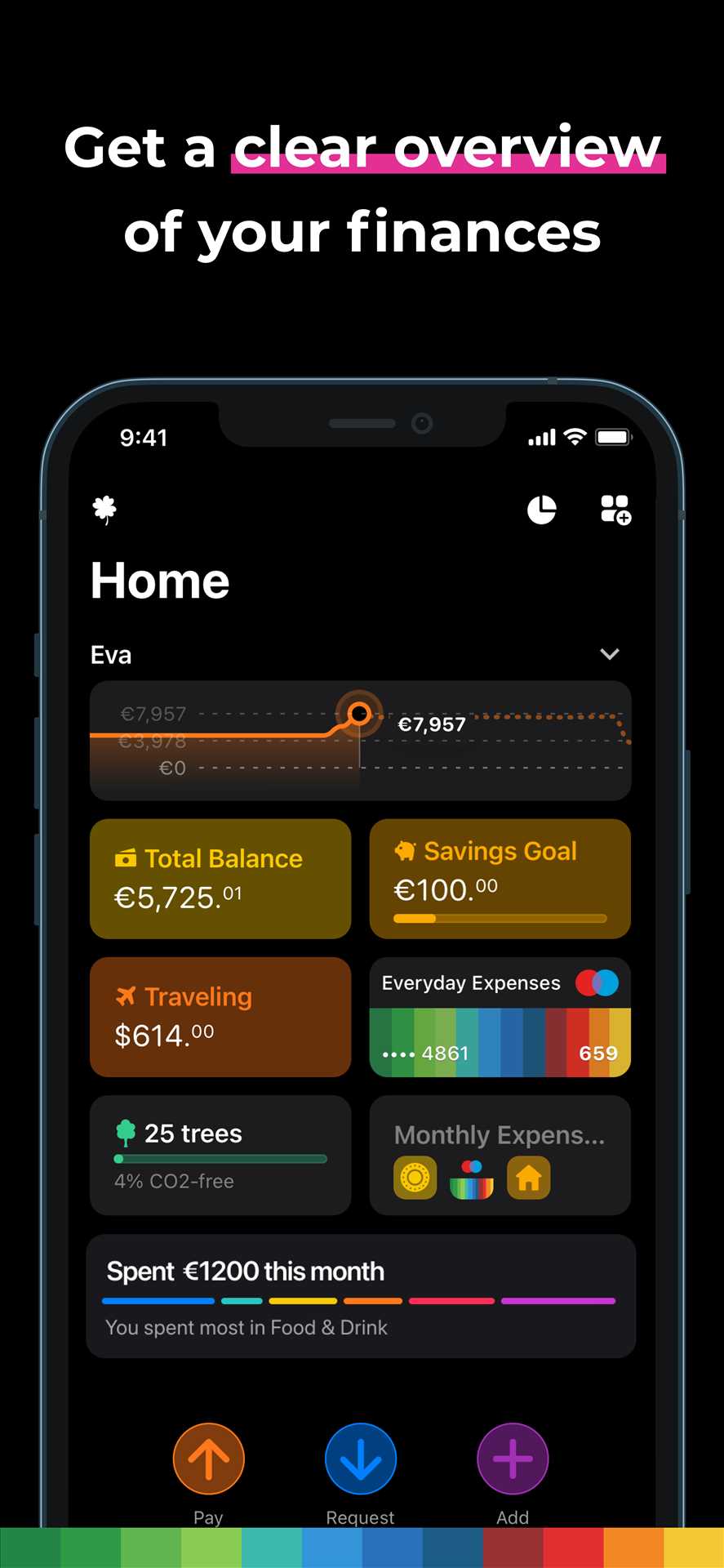

bunq operates in six languages with options to open 25 multicurrency accounts. You can either go cardless or have up to three physical cards and five virtual debit cards. With Bunq, you can send money requests, pay zero fees on international transactions, and it’s compatible with Apple Pay and Google Pay.

Pros & Cons

Pros:

-

Although it’s an independent bank, bunq is fully licensed under the Dutch Central Bank which offers added protection and bunq users’ funds are protected up to €100,000.00.

-

CVC code refreshes for additional security and you choose password or fingerprint protection

-

2.01% interest rate on all accounts.

-

MassInterest on deposits up to €100,000; no conditions on minimum

Cons:

-

Only available for residents of the EEA (You don't have to be a permanent resident of EEA, just a resident).

Who is it for?

As we’ve established, permanent residents of the EEA will benefit most from bunq. Especially those who travel internationally or plan on spending large periods of time abroad where the Euro is used, it’s great for securing rentals and taking care of domestic expenses while traveling between European countries.

bunq is also good for those who have poor credit scores and have trouble building their finances since there’s no credit check required.

On-Boarding Process

It’s extremely quick and easy to open a bunq account and you can start using it before your card even arrives. Instantly open up to 25 sub-accounts and joint accounts that you can start using right away.

Accounts & Pricing

Three types of personal accounts: bunq Core for €3.99 per month, bunq Pro for €9.99 per month and bunq Elite for €18.99 per month

With bunq Core plan, you get one free card. With bunq Pro and bunq Elite plans, you get 3 free cards and can pay €9.99 + €3.49 per month for every additional card. You can create a Joint account with all these plans.

For both bunq Pro and bunq Elite, you’re allowed 6 free ATM withdrawals per month before the €0.99 fee applies.

bunq also has Business plans, ranging from €7.99 to €23.99 per month. Depending on the plan, you can get 3 free cards and 4 free ATM withdrawals per month.

Key Features

-

Unlike many mobile banks, your bunq card is a credit card meaning that you’ll be able to use it anywhere Mastercard/Maestro is accepted.

-

When sending money requests, the people paying you don’t need to be bunq users.

-

Dutch users can easily switch from their current bank to bunq and automatically get all auto-payments and direct debits switched to a new bunq account.

-

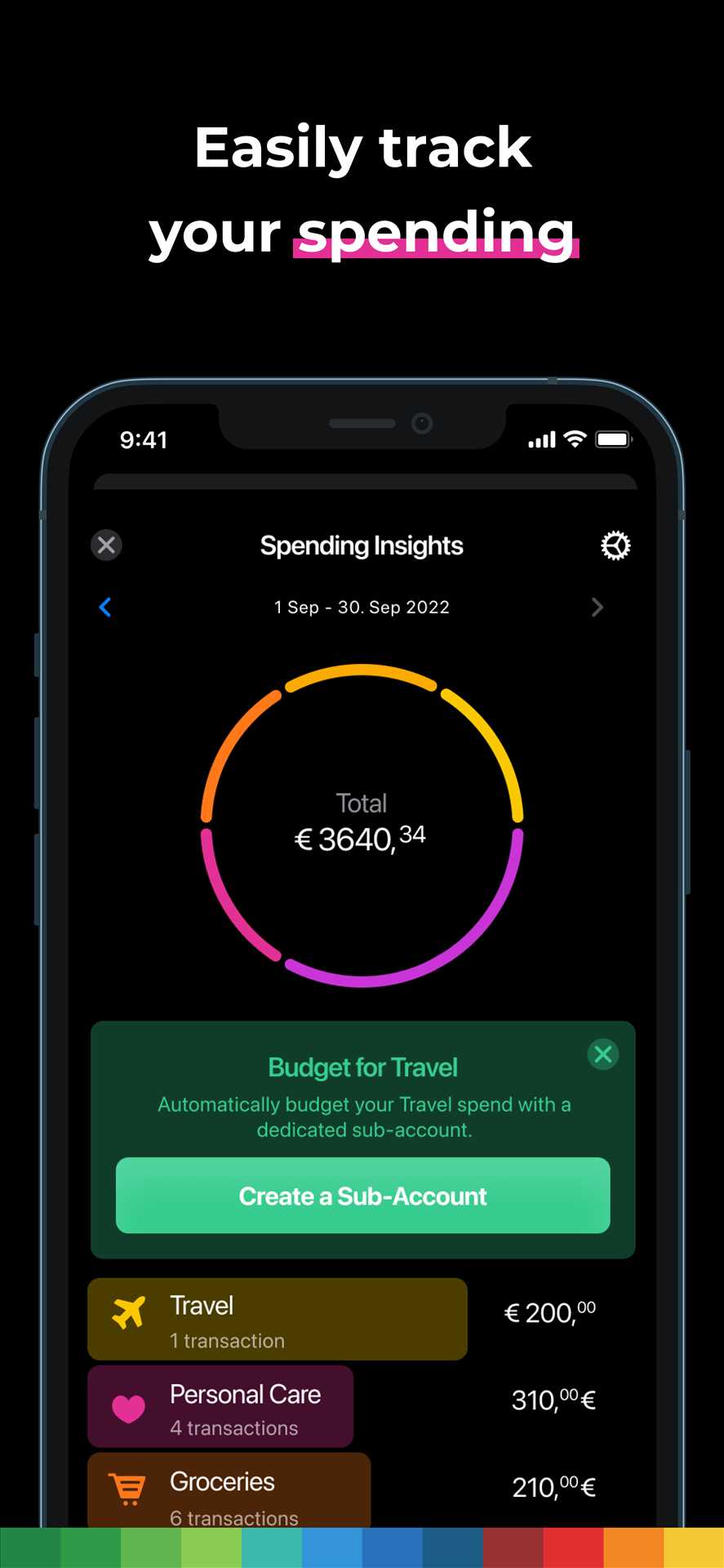

Create savings goals and choose auto-save options.

To Sum Up

If you live in the EEA and travel often or do business internationally, bunq could be a great mobile bank for you. bunq has incredible security features and with its association with the Dutch Central Bank, there are many perks.

However, it’s likely you’ll have to pay for the service you want as the free option isn’t great. And if you’re not a permanent resident of the EEA, bunq is unavailable to you.

Overall, if you don’t do a lot of traveling or international transactions, there’s probably a less pricey option when it comes to a mobile bank for everyday use.

bunq - Review

|

|

92

|

- Earn up to 2% cashback on eligible payments on credit cards.

- 2.01% Interest rate.

- 30 day free trial on any plan.

- Sub-accounts for easy budgeting

- Up to 6 monthly Free global ATM withdrawals.