XE Money Transfer Review

Company info:

XE is a peer-to-peer international money transfer business that allows users to bypass the banks and their fees. XE is focused on transferring money, both for personal and business purposes and can make transfers to well over 100 countries across the world, working with more than 60 currencies and there is no minimum or maximum daily transfer. Money transfers can be made 24/7 through XE’s website or a handy Mobile App (Apple Store and Android devices).

Pros & Cons:

Pros:

-

No transaction fees or any ongoing commission.

-

Bank-beating rates

-

Fees are transparent - No hidden fees.

-

There is no limit on transfers you can send each month.

-

24/7 customer support

-

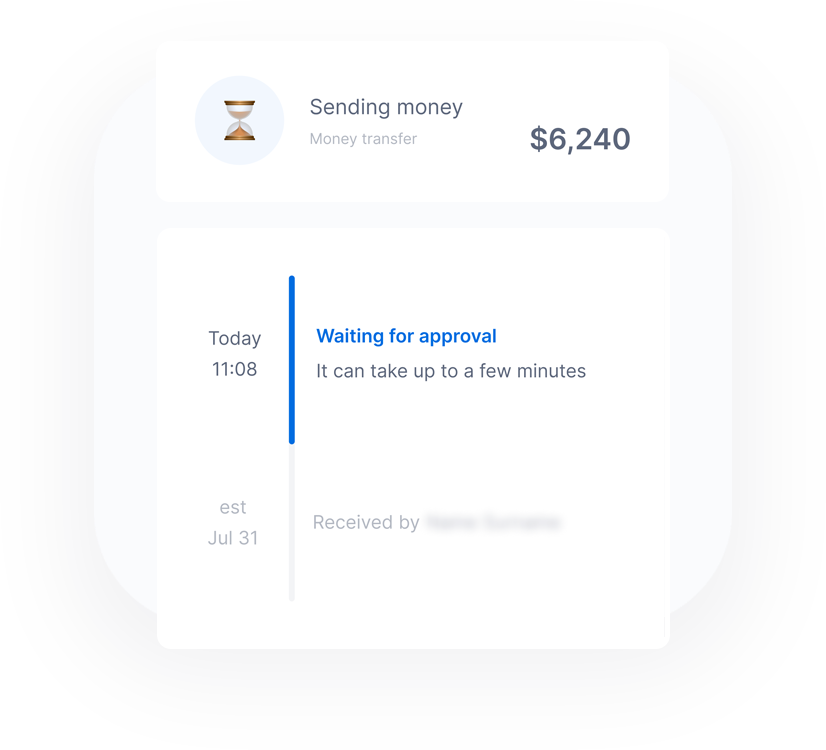

Most transfers are completed same day, and some of them in Minutes.

Cons:

-

Transfers must be sent to a bank account. No cash.

-

No credit card payment.

Accepted Countries:

Europe: Austria, Belgium, Denmark, Finland, France, Germany, Guernsey, Italy, Isle of Man, Jersey, Luxembourg, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the United Kingdom.

Australia & Oceania: Australia, New Zealand, French Polynesia, New Caledonia.

Americas: United States and Canada.

Africa: South Africa.

Onboarding process:

In order to open an account and start sending money with XE, there is a short registration process. Most customers, however, are onboard within a few minutes through eKYC and makes the user verification and authorization process completely digital. The required documents:

-

Proof of identity: ID / driving license / passport

-

Proof of address: insurance, tax bill, bank statement or any other utility bill.

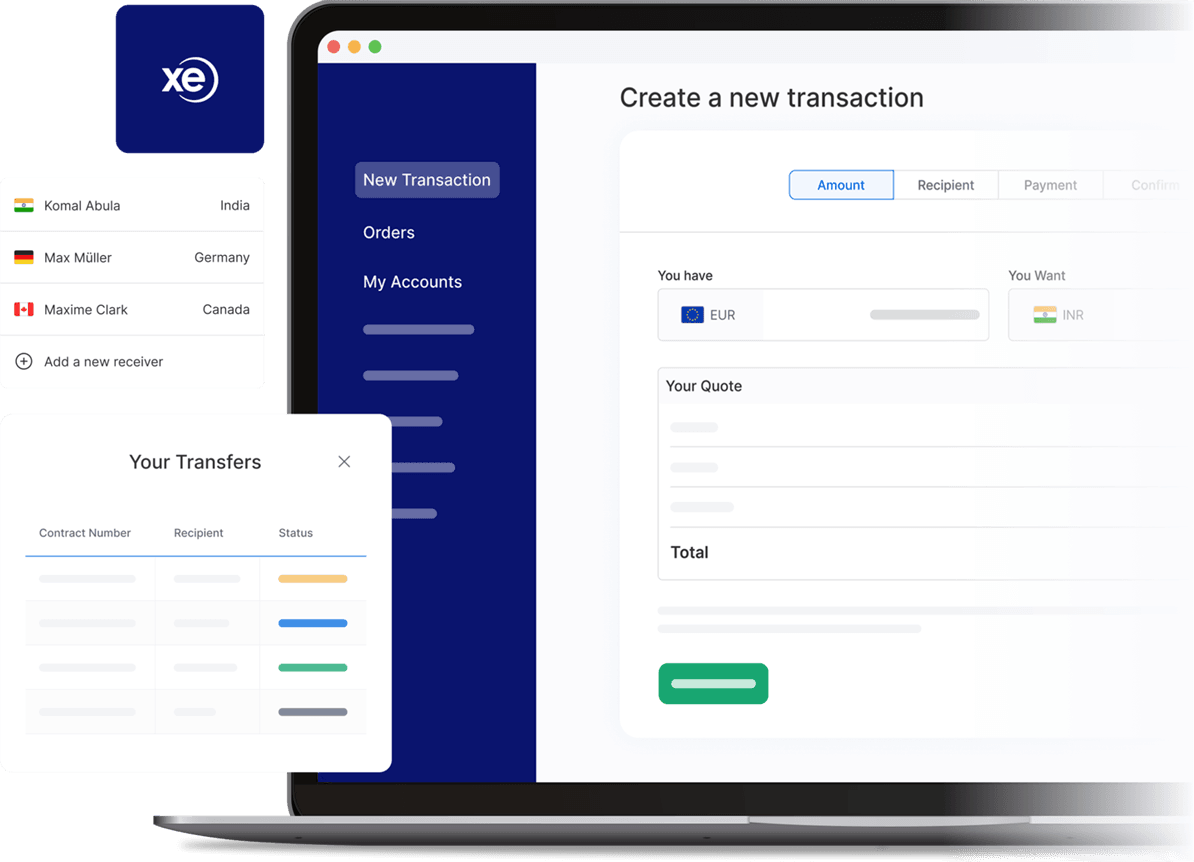

Sending / Receiving methods:

-

After your account is approved and confirmed, you can log in to XE.

-

Choose the currency you want to exchange and the amount you wish to send.

-

Provide your recipient’s bank details and confirm your payment method.

-

Approve & track your transfer. It takes 1-3 business days for the funds to be deposited in your recipient’s account.

Security:

Trust plays an essential role for XE and the company is internationally recognized:

- As a financial institution, XE is fully regulated by multiple authorities around the world: FCA, ASIC, FinCen and FMA.

- Over 275 million people visit Xe online every day (according to XE).

- Account and transaction protection using 2-factor authentication

To sum Up:

XE has been operating for more than 25 years which makes it one of the world’s top currency authorities. As a result of this experience, XE’s Money Transfer service is able to offer great exchange rates, advanced features, and helpful customer service. XE offers a competitive and affordable solution when you need to send money abroad.

XE Money Transfers

|

98

|

- Exchange 60+ currencies

- Transfer to 170+ countries

- Mobile Transfer

- Instant quotes

- Sign-up in minutes