Advantages of digital banks compared to traditional banks

Digital banks, also known as online or internet banks, offer a number of advantages compared to traditional banks. Some of the main advantages of digital banks include:

- Convenience - Most convenient app to manage your account

- Lower Fees compared to traditional high street banks

- Higher Interest Rates

- Better Technology

- Better costumer service

-

Convenience: Digital banks are typically available 24/7, so you can access your accounts and conduct financial transactions at any time, from anywhere with an internet connection. This is especially useful for people who have busy schedules or live in remote areas.

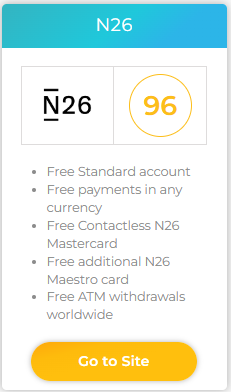

Our Editors' choice for the Best Overall app to manage your money: N26

- Features: N26 offers a seamless and intuitive mobile app interface, making account management effortless. From managing transactions to setting spending limits, N26 provides a suite of tools to meet users' financial needs.

- Advantages: Set-up daily spending limits, Lock or unlock your card, Reset your PIN, Receive push-notifications immediately for every account activity, Including card and mobile payments, ATM withdrawals, transfers and direct debits, Login to the app using secure fingerprint, “N26 Spaces” - create sub-accounts for all your different goals or purposes and keep them all together. That way you can save money more easily and be in full control over your money.

- Availability: All EU Countries, Not available in the UK.

-

Lower fees: Digital banks often have lower fees than traditional banks because they don't have the same overhead costs. This means you can save money on things like ATM fees, monthly maintenance fees, and overdraft charges.

-

Higher interest rates: Digital banks often offer higher interest rates on savings accounts and other deposit products because they don't have the same physical infrastructure costs as traditional banks. This means you can earn more money on your savings.

-

Better technology: Digital banks typically have advanced digital platforms that make it easy to manage your money and conduct financial transactions. This includes features like mobile banking apps, online bill pay, and instant money transfers.

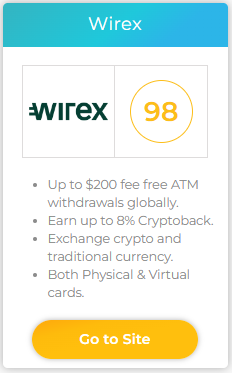

Our Editors' choice for the most cutting-edge technology app to manage multi-currencies: Wirex

- Features: Wirex highly advanced app offers it's users the ability to easily Spend cash, stablecoins, and crypto anywhere, making multi-currency management simple and cheaper.

- Advantages: Up to £200 fee free ATM withdrawals globally, Earn up to 8% Cryptoback, Spend cash, stablecoins, and crypto anywhere via card, Both Physical & Virtual cards, world-class security including Two-step verification.

- Availability: All EU Countries, UK, US.

-

Better customer service: Digital banks often have more responsive customer service than traditional banks because they are typically more focused on providing excellent service to their customers. This means you can get help and support when you need it, without having to wait in line at a branch or call a busy call center.

Find our latest rankings and compare it yourself: