FairFX Travel Card Review

Review of FairFX Travel Card: Your Trusty Companion for International Adventures

If you're someone who loves to explore the world, you know that managing money while traveling can sometimes be a hassle. Between fluctuating exchange rates, hidden fees, and the challenge of keeping track of multiple currencies, travel expenses can quickly become a headache. That's where the FairFX Travel Card steps in—a solution that’s designed to make your financial life easier when you're on the move.

What Makes the FairFX Travel Card Stand Out?

1. Competitive Exchange Rates One of the biggest perks of the FairFX Travel Card is the competitive exchange rates it offers. Unlike traditional bank cards that can hit you with unfavorable rates, FairFX locks in your exchange rate when you load the card. This means you can avoid unpleasant surprises and budget more accurately for your trip.

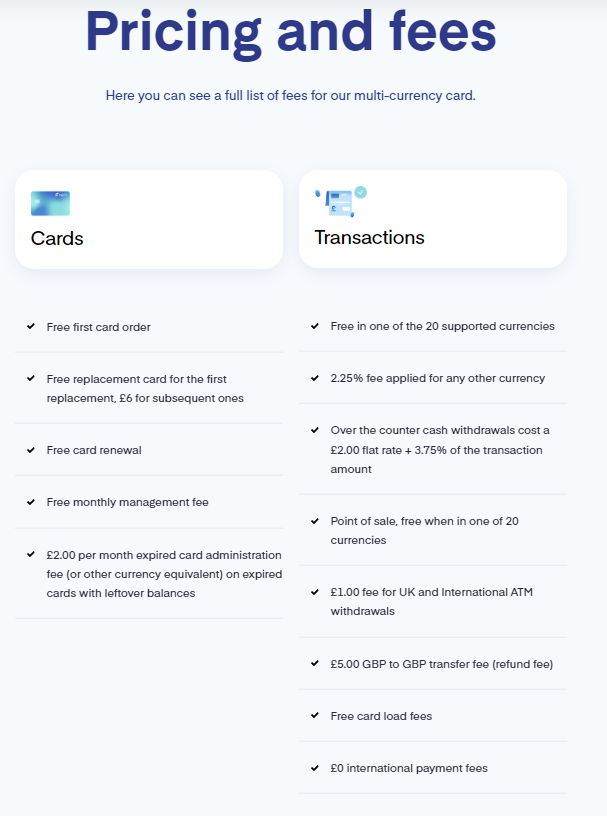

2. No Hidden Fees. Hidden fees can ruin the best-laid travel plans. Thankfully, FairFX is upfront about its costs, so you won’t be caught off guard by unexpected charges. Transaction fees for spending abroad are 2.25%-3.75% (Depends on the currency) of the transaction amount, and the card offers £2.00 flat rate ATM withdrawals in certain currencies. This transparency is a breath of fresh air compared to many other travel cards out there.

3. Multi-Currency Flexibility Whether you're jetting off to Europe, the U.S., or Australia, the FairFX Travel Card has you covered. You can load multiple currencies onto a single card, which makes it incredibly convenient if you’re visiting multiple countries on the same trip. It’s like having a virtual wallet for all your currencies in one place.

4. Easy to Use Ease of use is a significant advantage of the FairFX Travel Card. The mobile app is intuitive and user-friendly, allowing you to check your balance, top up your card, and track your spending in real time. This level of control means you can manage your money on the go, no matter where you are in the world.

5. Safe and Secure Safety is always a concern when traveling, especially when it comes to your finances. The FairFX Travel Card is not linked to your main bank account, adding an extra layer of security. Plus, if your card is lost or stolen, you can instantly block it through the app, giving you peace of mind.

Notice: FairFX accounts don’t fall under the Financial Services Compensation Scheme, instead your money is protected via safeguarding. We hold your funds in specially designated, safeguarded bank accounts, which keep them separate from our other assets.

6. Virtual Card Benefits In addition to the physical card, FairFX also offers a virtual card option, which is perfect for online transactions while you're abroad. The virtual card can be generated instantly, providing a secure and convenient way to manage your online purchases without exposing your primary account information. This is particularly beneficial for travelers who prefer not to carry a physical card or want to keep their spending separate for better budgeting.

Pros and Cons

Pros:

- Competitive Exchange Rates: Lock in rates when you load the card, ensuring you get the best value for your money.

- No Hidden Fees: Transparent fee structure with no foreign transaction fees and free ATM withdrawals in supported currencies.

- Multi-Currency Support: Manage multiple currencies on one card, ideal for multi-destination trips.

- User-Friendly App: Easy to manage your finances on the go with a highly intuitive app.

- Security: Not linked to your bank account, reducing the risk if the card is lost or stolen.

- Virtual Card: Instantly generated virtual card for secure online transactions.

Cons:

- Inactive Fee: If the card isn’t used for 15 months, a small inactivity fee is charged.

- Reload Time: Depending on your payment method, it might take a few hours for funds to appear on the card.

- Limited Currency Options: While it supports major currencies, it may not cover every destination.

Pricing

Initial Cost:

The FairFX Travel Card typically costs £9.95. However, they often run promotions where you can get the card for free if you load a certain amount of money during signup.

ATM Withdrawals:

Free for supported currencies like EUR, USD, and GBP (up to a certain limit).

For other currencies, there might be a small fee, usually around €1.50 per withdrawal.

Top-Up Fees:

Free via bank transfer.

Credit and debit card top-ups may incur a small fee.

Inactivity Fee:

£2 per month if the card is inactive for 15 months.

Top8neobanks' Expert Opinion:

"The FairFX Travel Card is more than just a convenient way to pay for things abroad; it's a tool that helps you manage your money smarter and travel with confidence. From locking in favorable exchange rates to offering multi-currency options and transparency with fees, FairFX truly understands the needs of modern travelers. If you’re planning a trip and want a reliable, hassle-free way to handle your finances, the FairFX Travel Card is definitely worth considering. Just keep in mind the inactivity fee and reload times, and you’ll be set for smooth financial management on your travels."

FairFX

.png)

|

96

|

- Free Prepaid Multi-currency Mastercard card

- Travel Money

- International payments

- Just £1 ATM fee applies in the UK & abroad per withdrawal