No Credit Check Neobanks Accounts

Finding a neobank that doesn't require proof of address, tax identification number (TIN), or a credit check can be challenging, as most financial institutions need to comply with Know Your Customer (KYC) and anti-money laundering (AML) regulations. However, some neobanks are known for their more streamlined and less stringent onboarding processes. We have gathered a list of the leading Neobanks that fit this criteria.

The Following Neobanks do not require proof of address, TIN or credit check to open an account with:

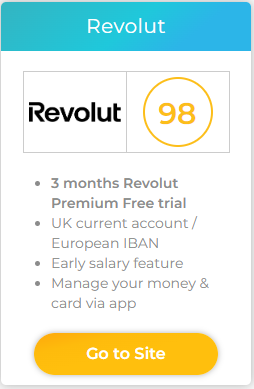

1. Revolut - Here is the most recent information on how to Get started with Revolut:

Eligibility

You must be over the age of 18 and be a legal resident of a supported country.

For people aged between 6 and 17, learn about our <18 Revolut accounts.

Required information

In order to open and use your account, you must provide the following:

- Valid mobile phone number

- Valid email address

- Personal information, including but not limited to: current address, date of birth, full name, and citizenship(s)

- Valid government-issued document for identity verification

- Selfie for account security

You may also be asked a few questions about yourself and the purpose of your account. These questions will not impact your eligibility.

Is Revolut free?

Opening and using a Revolut account is free. You can upgrade your account to one of our paid plans to save money on fees and access additional benefits.

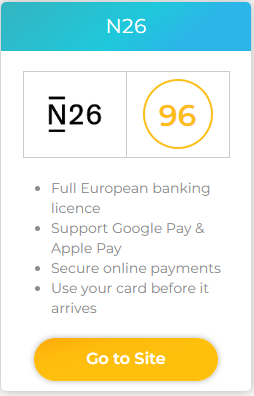

2. N26 - You can open an account with N26 if you:

- are at least 18 years old

- are a resident of a supported country - Austria, Belgium, Denmark, Estonia, Finland, France (not available for residents in the DOM/TOM), Germany, Greece, Iceland, Ireland, Latvia, Liechtenstein, Lithuania, Luxembourg, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden & Switzerland. Not available for UK residents

- own a compatible smartphone

- hold a supported ID

- don't already have an account with us

- are able to verify yourself in one of our supported languages: English, German, Spanish, Italian, or French.

- If you open your account in Spain, please make sure to provide a valid Tax ID (as per art. 202, Ley General Tributaria 58/2003).

This is how the sign-up process for an N26 bank account works:

- Confirm your email, personal details and shipping address.

- Select your account type (personal or business).

- Connect your smartphone to your new account.

- Prove your identity.

- As a new signup, you'll be able to top up your account via Bank Transfer or CASH26 deposit (if you are in Germany, Austria or Italy).

- After a few days, you’ll receive your N26 Mastercard by post.

*If you meet N26's minimum creditworthiness criteria, you can open an N26 account. If you don’t, N26 may offer you an N26 Flex account (Germany only). This decision is calculated through an automated process. N26 Flex account

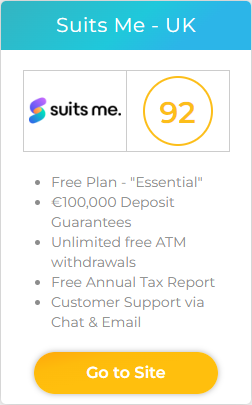

3. Suits Me - To open your Suits Me account, you need:

- To be aged 18 or over to apply

- To have an address in the UK (where we can send you card, we don't need proof of address)

- To have one form of ID (UK driving license, passport or a national ID card)

You can open your Suits Me current account today within 10 minutes.

How do I open a Suits Me account?

To open a Suits Me current account use the following link

Opening your account is quick and easy using an online application form.

Once complete, your account will be open within 10 minutes and you’ll gain instant access to your account number and sort code. Your free contactless Mastercard® debit card will then arrive in the post within 3-5 working days which contains a letter with instructions to activate your online money account.

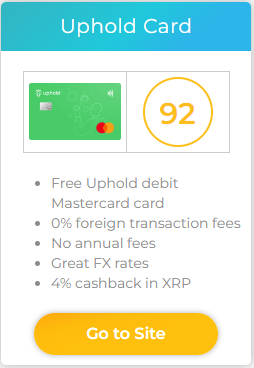

4. Uphold - To get started with Uphold, you'll need the following things:

- Citizenship or residency in a country where Uphold operates - Most EU countries are eligible, including the UK.

Uphold cannot onboard new customers from Germany and Netherlands at the moment. Here is a list of other unsupported countries. - A smartphone or computer with an internet connection - and don't forget to keep your software up to date.

- The newest version of the Uphold app, available in the iOS or Android app store.

- A valid government-issued ID.

- You've got to be at least 18 years old.

How do I sign up to Uphold?

Joining Uphold takes less than 10 minutes:

- Use the following link to get the Uphold app

- Open the Uphold app and tap the "Sign up" button.

- Fill in your personal details, including your email address, phone number, physical address, and country of residence and citizenship.

- Take a moment to review and agree to our terms of use.

- Depending on where you're based, you may be asked about your intended use of the platform, your employment status, and income.

- Next up, we'll need you to verify your identity using your government-issued ID. It's a quick process.

- That's it - you're all set!

When choosing a neobank, always review their specific requirements on their official website or contact their customer service to get the most accurate and up-to-date information. Additionally, consider that while some neobanks might initially have fewer requirements, accessing certain features or higher transaction limits may necessitate additional verification later on.