How Neobanks Work?

Neobanks, also known as digital banks or challenger banks, operate primarily through digital platforms without traditional physical branch networks. They leverage technology to offer a wide range of financial services with lower costs and greater convenience compared to traditional banks. Here’s an overview of how neobanks work:

How Neobanks Work

1. Digital-First Approach

Mobile and Online Platforms:

Neobanks operate through mobile apps and websites, allowing customers to manage their finances anytime, anywhere. This digital-first approach eliminates the need for physical branches, reducing overhead costs and enabling them to offer competitive fees.

2. Account Opening and Management

Easy Onboarding:

Signing up for an account with a neobank is usually a quick and straightforward process. Users can download the app or visit the website, provide their personal information, and complete identity verification by uploading documents such as a passport or driver’s license and taking a selfie.

Real-Time Account Management:

Once the account is set up, users can manage their finances in real-time. This includes checking balances, transferring money, paying bills, and monitoring transactions through the app or online portal.

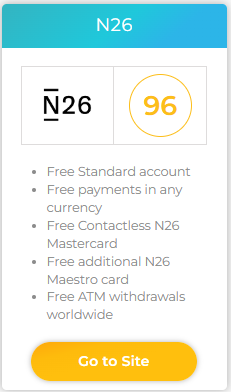

- Features: N26 offers a seamless and intuitive mobile app interface, making account management effortless. From managing transactions to setting spending limits, N26 provides a suite of tools to meet users' financial needs.

- Advantages: Set-up daily spending limits, Lock or unlock your card, Reset your PIN, Receive push-notifications immediately for every account activity, Including card and mobile payments, ATM withdrawals, transfers and direct debits, Login to the app using secure fingerprint, “N26 Spaces” - create sub-accounts for all your different goals or purposes and keep them all together. That way you can save money more easily and be in full control over your money.

- Availability: All EU Countries, Not available in the UK.

3. Cost-Effective Services

Lower Fees:

Neobanks often offer lower fees than traditional banks. They typically provide fee-free or low-cost account maintenance, transactions, and foreign currency exchanges. The savings from not maintaining physical branches are passed on to customers.

Competitive Exchange Rates:

Many neobanks offer competitive exchange rates for international transactions, making them a popular choice for travelers and those who deal with multiple currencies.

4. Advanced Financial Tools

Budgeting and Analytics:

Neobanks provide tools for budgeting and financial analytics. Users can set spending limits, categorize expenses, and receive insights into their spending habits, helping them manage their finances more effectively.

Savings and Investments:

Some neobanks offer features like savings vaults or goals, automated savings plans, and investment options, allowing users to grow their money efficiently.

-

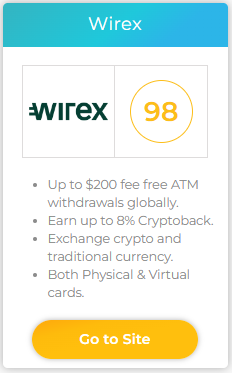

Our Editors' choice for the most cutting-edge technology app to manage & invest in multi-currencies: Wirex

- Features: Wirex highly advanced app offers it's users the ability to easily Spend cash, stablecoins, and crypto anywhere, making multi-currency management simple and cheaper.

- Advantages: Up to £200 fee free ATM withdrawals globally, Earn up to 8% Cryptoback, Spend cash, stablecoins, and crypto anywhere via card, Both Physical & Virtual cards, world-class security including Two-step verification.

- Availability: All EU Countries, UK, US.

5. Security and Customer Support

Advanced Security Measures:

Neobanks prioritize security with measures such as encryption, two-factor authentication (2FA), biometric login (fingerprint or facial recognition), and instant card locking/unlocking. These features help protect users' accounts and personal information.

Customer Support:

Customer support is typically available through in-app chat, email, or phone. Many neobanks offer 24/7 support to address customer inquiries and issues promptly.

6. Integration with Other Financial Services

APIs and Open Banking:

Neobanks often use APIs (Application Programming Interfaces) to integrate with other financial services and applications. This allows users to connect their neobank account with budgeting tools, payment services, and investment platforms.

7. Regulatory Compliance

Licensing and Regulation:

Neobanks are licensed and regulated by financial authorities in the countries where they operate. This ensures they adhere to legal standards and protect customers' funds. In some regions, neobanks partner with traditional banks to offer services under their banking license.

Conclusion

Neobanks provide a modern, convenient, and cost-effective alternative to traditional banking. By leveraging technology and a digital-first approach, they offer a range of financial services with enhanced user experience, lower fees, and advanced financial tools. This makes them particularly attractive to tech-savvy individuals, frequent travelers, and those seeking a more efficient way to manage their finances.

In the following article you can find Everything you should know about Neobanks and the advantages of using these services.

Everything you should know about Neobanks

Find our latest rankings and compare it yourself: