Does Equals Money is the Right Solution for Your Business?

In today’s global business world, managing finances efficiently is essential. Whether you run a small business, manage finances at a mid-sized company, or work in a large enterprise, the need for reliable and cost-effective financial solutions is universal. Equals Money offers services like international payments, multi-currency accounts, corporate cards, and expense management tools to meet these needs.

When choosing a financial service provider, it’s important to find one that simplifies your operations while providing flexibility, security, and value. Equals Money is quickly becoming a top choice for businesses of all sizes due to its comprehensive services and user-friendly approach.

This review will explore how Equals Money can benefit your business, covering key features, advantages, and potential considerations. Whether you need help with cross-border payments, multi-currency transactions, or expense management, this guide will help you decide if Equals Money is the right fit for your financial needs.

Company Background

- Founded as FairFX in 2007; rebranded to Equals Money.

- Evolution from travel money service to comprehensive financial platform.

- Mission: Provide equal access to financial tools for business empowerment.

- Reputation: Known for reliability, transparency, and innovation.

- Serves thousands of businesses across various industries.

Core Services Offered by Equals Money

International Payments

- Supports payments in over 100 currencies across 190 countries.

- Competitive exchange rates and low fees for cost-effective transactions.

- Transparency: Clearly shows exchange rates and fees before transactions.

- Features include:

- Forward contracts for currency hedging.

- Market orders to protect margins against currency fluctuations.

Multi-Currency Account & IBAN

- 38 Currencies - 1 Account

- Flexible Multi-Currency Accounts: Open single or multiple own-named multi-currency accounts tailored to your business needs.

- Streamlined Payment Experience: Eliminate long wait times and poor communication associated with traditional payment providers. [✓] Reduces need for frequent conversions, [✓] avoiding unfavorable rates.

- Integration with other Equals Money services:

- International payments.

- Corporate cards.

- Simplifies cash flow management for businesses with international clients.

- Liquidity Access: Benefit from access to liquidity through Tier 1 banks, enabling Equals Money to offer a wide range of currencies at competitive rates.

- Seamless Integration: Integrated with multiple international bank accounts, facilitating local currency settlements with ease.

- Global Payment Networks: Enjoy access to SWIFT, UK Faster Payments, SEPA, and SEPA Instant for efficient and reliable global transactions.

- Personalized Support: Benefit from dedicated account management and compliance resources to guide you smoothly through the onboarding process.

Corporate Cards

- Preloaded cards in multiple currencies, ideal for international purchases.

- Real-time tracking of expenses linked to the Equals Money platform.

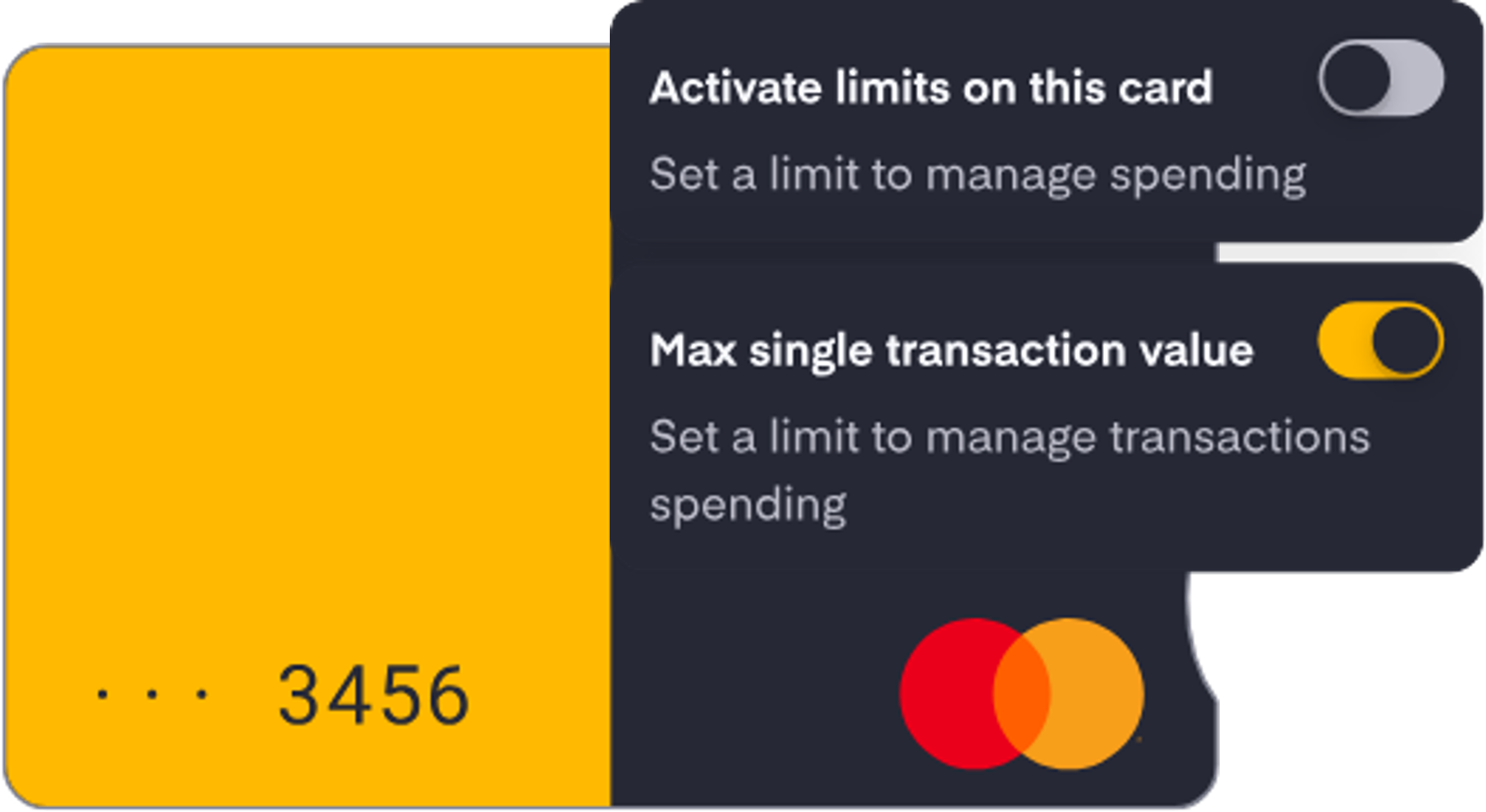

- Features include:

- Spending limits.

- Instant card management through the platform.

- Helps businesses control and monitor employee spending.

- Virtual cards are also available:

- Perfect for online purchases

- Can be alocated to individuals and/or teams

- Can be attached to a specific balance or budget within the expense management platform.

- Instant issuing.

Expense Management Tools

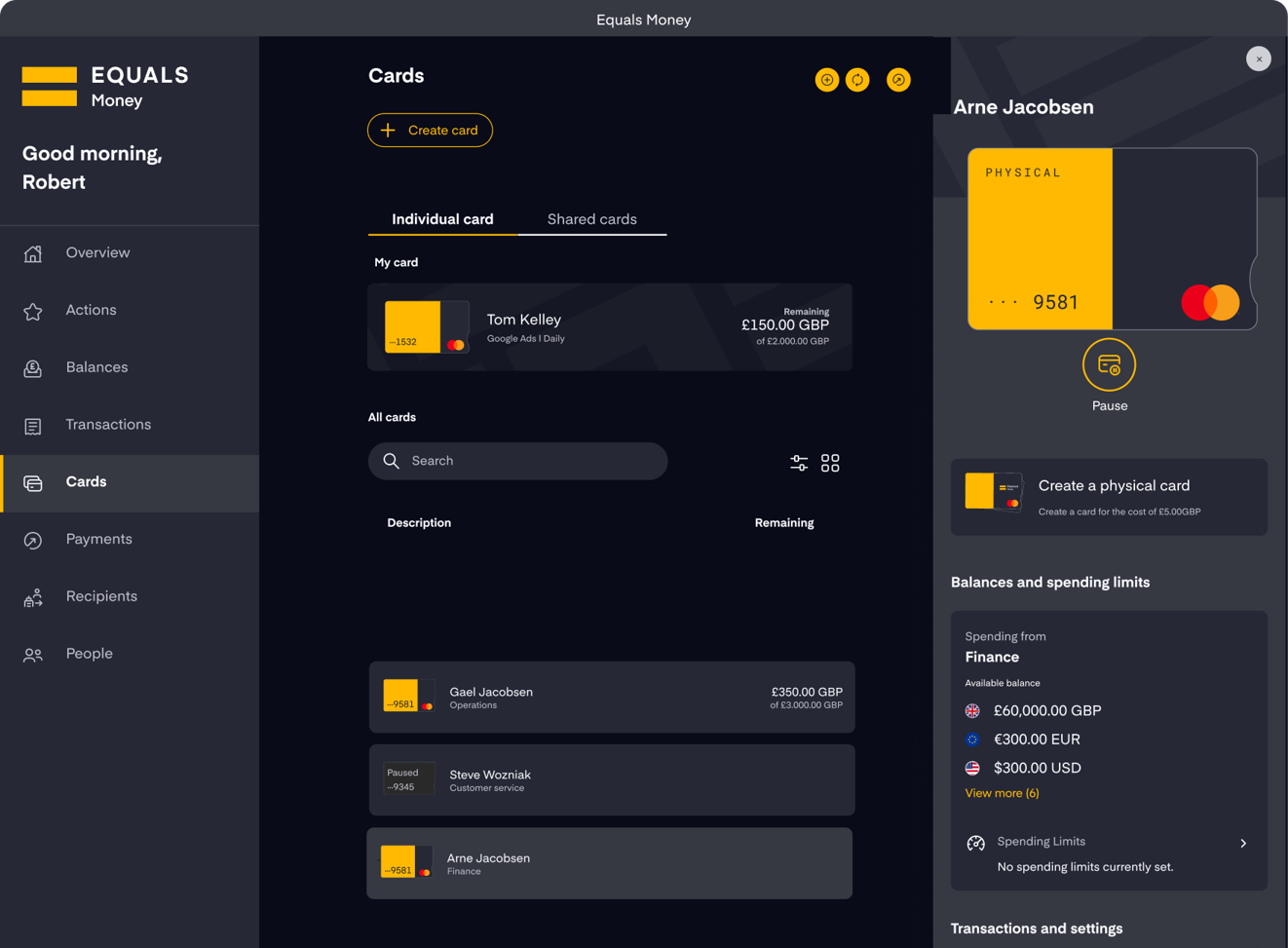

- Manage and control your businesses multi-currency expense cards in real-time using the online platform.

- Comprehensive platform for real-time expense tracking.

- Automated expense reports and integration with accounting software (Xero, QuickBooks).

- Multiple currencies: Cards can be used in over 190 countries.

- Funds requests: Users can request funds using the mobile app.

- Dedicated support: Equals Money's account management team are available to support your business.

- Benefits for businesses:

- Easier management of employee spending.

- Streamlined expense approvals.

- Improved visibility into financial outflows.

- User-friendly interface, accessible to both finance teams and employees.

Product Comparison

Equals Money vs. traditional banks:

- Straightforward, easy-to-understand pricing model.

- Faster processing times with transparent fee structures.

Unique Selling Points (USPs):

- Integrated platform for a cohesive financial management experience.

- Support for both fiat and cryptocurrencies.

Advantage: Forward-thinking features position Equals Money as a future-ready solution.

User Experience

- Intuitive, straightforward platform design.

- Online dashboard:

- Clear overview of accounts, transactions, and pending actions.

- Mobile app mirrors functionality for on-the-go financial management.

- Customer support:

- Dedicated support channels for businesses (phone, email, live chat).

- Responsive assistance readily available when needed.

Security and Compliance

- Advanced encryption protocols to protect sensitive data.

- Regulated by the Financial Conduct Authority (FCA) in the UK.

- Compliance with strict financial regulations and industry standards.

- Additional security features:

- Anti-fraud measures.

- Two-factor authentication for enhanced protection.

A Case Study for example

To illustrate the real-world benefits of Equals Money, consider a medium-sized manufacturing company that regularly imports materials from multiple countries. Before using Equals Money, the company struggled with high fees and poor exchange rates offered by traditional banks, which cut into their profit margins. After switching to Equals Money, the company was able to lock in favorable exchange rates through forward contracts, significantly reducing costs. The ability to manage multi-currency accounts also streamlined their financial processes, saving time and reducing errors.

Another example is a tech startup with a remote workforce spread across different countries. By utilizing Equals Money’s corporate cards and expense management tools, the company was able to control and monitor employee expenses more effectively, eliminating the need for manual expense reports and reducing administrative overhead.

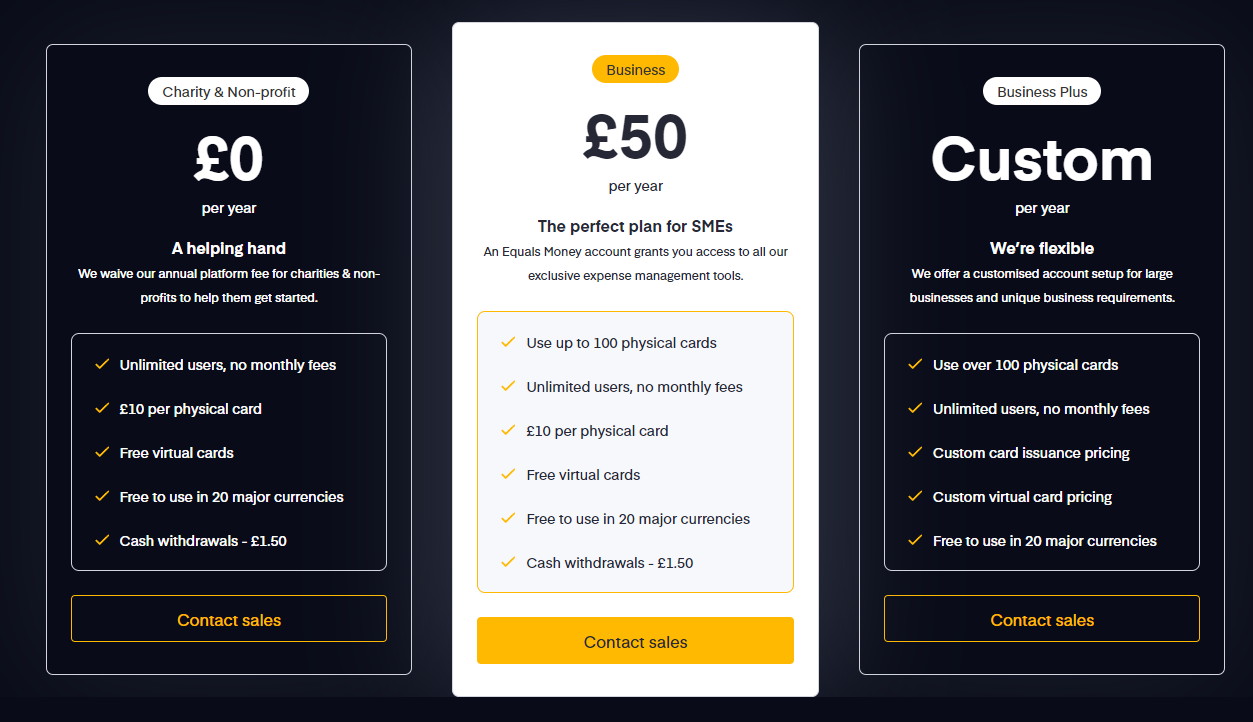

Pricing and Fees

- Transparent pricing with competitive exchange rates and low transaction fees.

- No hidden costs; fees clearly displayed before transactions.

- Cost-effectiveness compared to traditional banking solutions.

- Potential for significant savings over time.

Pros and Cons

Pros:

- Competitive exchange rates and low fees: significant savings on international transactions.

- Multi-currency accounts: flexibility in managing global finances.

- Integrated platform: cohesive experience that simplifies financial management.

- User-friendly interface: easy navigation, both online and via mobile app.

- Advanced security measures: ensures safety of transactions and data.

- Excellent customer support: responsive and knowledgeable assistance.

Cons:

- Limited physical presence: primarily operates online, may be a drawback for those preferring in-person banking.

- Geographical limitations: some services may not be available in all countries due to local regulations.

Conclusion

- Equals Money offers a comprehensive, efficient solution for business financial management.

- Services cater to the needs of global operations.

- Key Benefits:

- Reduced costs.

- Streamlined expense management.

- Enhanced control over multi-currency transactions.

- Positioned as a valuable tool for businesses seeking to navigate international finance complexities.

Top8NeoBanks Editor's Note:

"The Equals Money business account is a robust solution for SMEs and larger businesses that require efficient international payments, multi-currency management, and comprehensive expense control. Its competitive pricing, user-friendly platform, and excellent integration capabilities make it a strong contender in the fintech space. However, businesses seeking a full suite of traditional banking services may need to supplement Equals Money with additional financial products. Overall, Equals Money provides a valuable service for businesses with international operations and complex expense management needs."

If you’re interested in learning more about how Equals Money can benefit your business, visit their website to explore their full range of services or contact their support team for a personalized consultation.

Equals Money Business - Banks

|

82

|

- Making expense management simple for over 20,000 businesses

- Work around the world – cards can be used in over 190 countries where Mastercard is accepted

- Prepaid multi-currency Mastercard card with an IBAN