Monese Review

- Get £10 after 1st card transaction. code: NEOBANKS. T&C apply

- Earn up to £450 when you invite your friend. That's up to £30 for each new friend you refer.

Company Information

Monese was founded in 2015 in the UK by Norris Koppel in order to change the rules of the traditional banking in the financial world. The main goal of the company was opening and using an account as easy as ordering an Uber, while also ensuring it will be accessible to everyone and not just a select few with perfect credit scores and several month’s worth of utility bill documentation. Today, Monese has around 3000 sign ups a day and customers are moving over $3 billion each year through their Monese accounts.

Pros and cons

Pros:

-

Built-in Bills and Purchase protection for UK clients (paid plans).

-

Fast and easy set-up with no credit check or proof of local address needed.

-

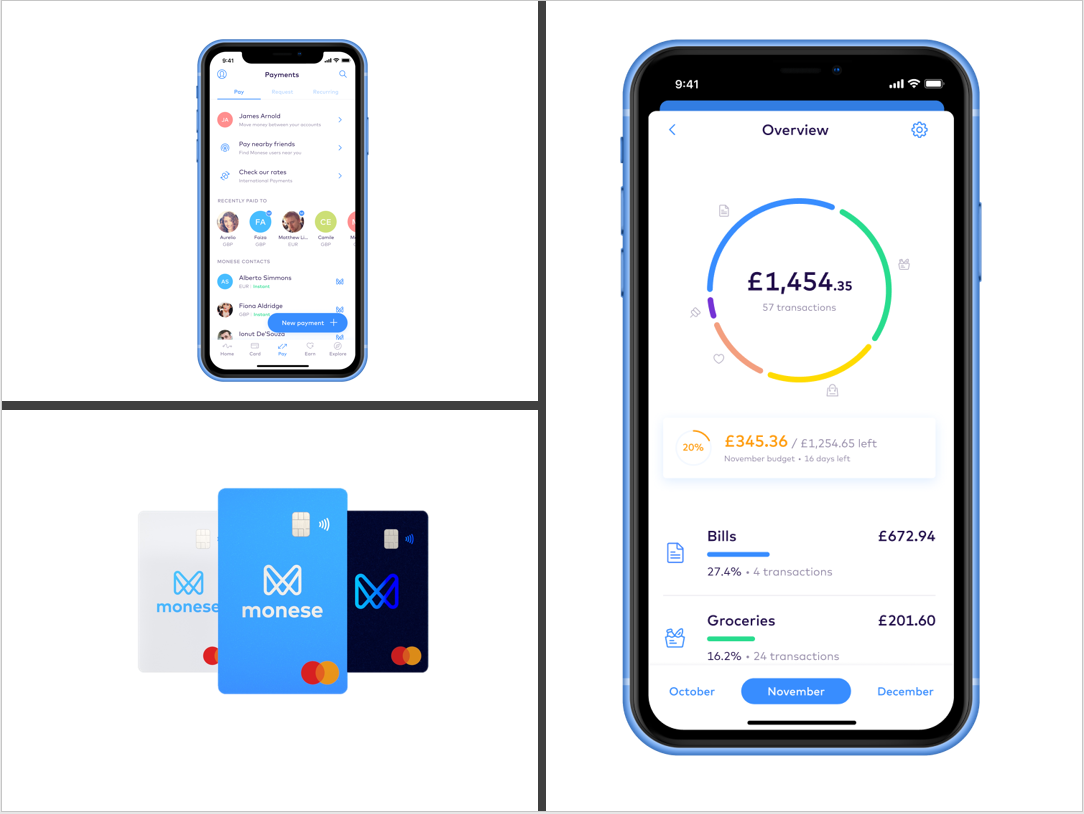

Great mobile app with multiple functions and easy to use.

-

Direct debits and standing orders via UK current account.

-

Free cash loading into the account.

-

Fast and easy account set up.

Cons:

-

No physical branches..

-

2% fee when transferring money to non-Monese accounts.

Who is it for?

If you're at least 18 years old and live in the European Economic Area (EEA), you can open an account with Monese, regardless of your citizenship or financial history.

Accounts & Pricing

1. Starter Account:

Monthly Price: Free

- Contactless debit card:

FREE Standard card +

£4.95 for delivery

- ATMs & cash top-ups:

£1.5 fee on ATM withdrawals

3.5% fee on Cash top-ups

- Foreign currency card spending:

2% fee

- Foreign currency transfers:

FREE & instant to other Monese accounts. 2.5% fee, additional 1% fee on weekends

2. Classic Account

Monthly Price: €/£5.95

- Contactless debit card:

FREE Holographic edging card

- ATMs & cash top-ups:

£500 FREE monthly ATM withdrawals

£500 Free monthly Cash top-ups

- Foreign currency card spending:

FREE

- Foreign currency transfers:

FREE & instant to other Monese accounts. from 0.5% fee when sending to non-Monese accounts - £2 minimum fee

-

Built-in Bills and Purchase protection for UK clients.

3. Premium Account:

Monthly Price: €/£14.95

- Contactless debit card:

FREE Premium card

- ATMs & cash top-ups:

£1,500 FREE monthly ATM withdrawals

£1,500 Free monthly Cash top-ups

- Foreign currency card spending:

FREE

- Foreign currency transfers:

FREE & instant to other Monese accounts FREE when sending to non-Monese accounts

-

Built-in Bills and Purchase protection for UK clients.

Key features

- Open an account in minutes, with no credit checks

- Automatic Bills & Purchase protection (Paid plans)

- Multi-currency accounts - GBP, EUR, RON

- Bills protection included in paid plans

- Send money abroad at great rates

Monese Referr-A-Friend program

Make up to £30 for each new friend who joins and starts using Monese.

You can earn up to £450(!) in total from friends who joined Monese.

Bottom line:

Monese can be a great option for people in the EEA who want to open an account in another country and for travellers. The monese debit card based on Mastercard, can be used for low-cost cash withdrawals and offer a very good contactless payment options. In conclusion, Monese gives its customers a very complete mobile banking package.

Monese review

|

96

|

- Free Starter account + Card & Virtual card

- Open an account in minutes, with no credit checks

- EUR account & Sort code

- Send money abroad at great rates