Chase UK Review

Company info & Overview:

Chase, the digital banking arm of JPMorgan Chase, has made a significant splash in the UK banking market with its comprehensive suite of financial products. Known for its customer-centric approach and innovative features, Chase UK offers a range of digital banking services, including a current account, a linked debit card, and an attractive savings account. Let’s dive into what makes Chase UK a compelling choice for your banking needs.

Key Features of Chase UK Digital Banking

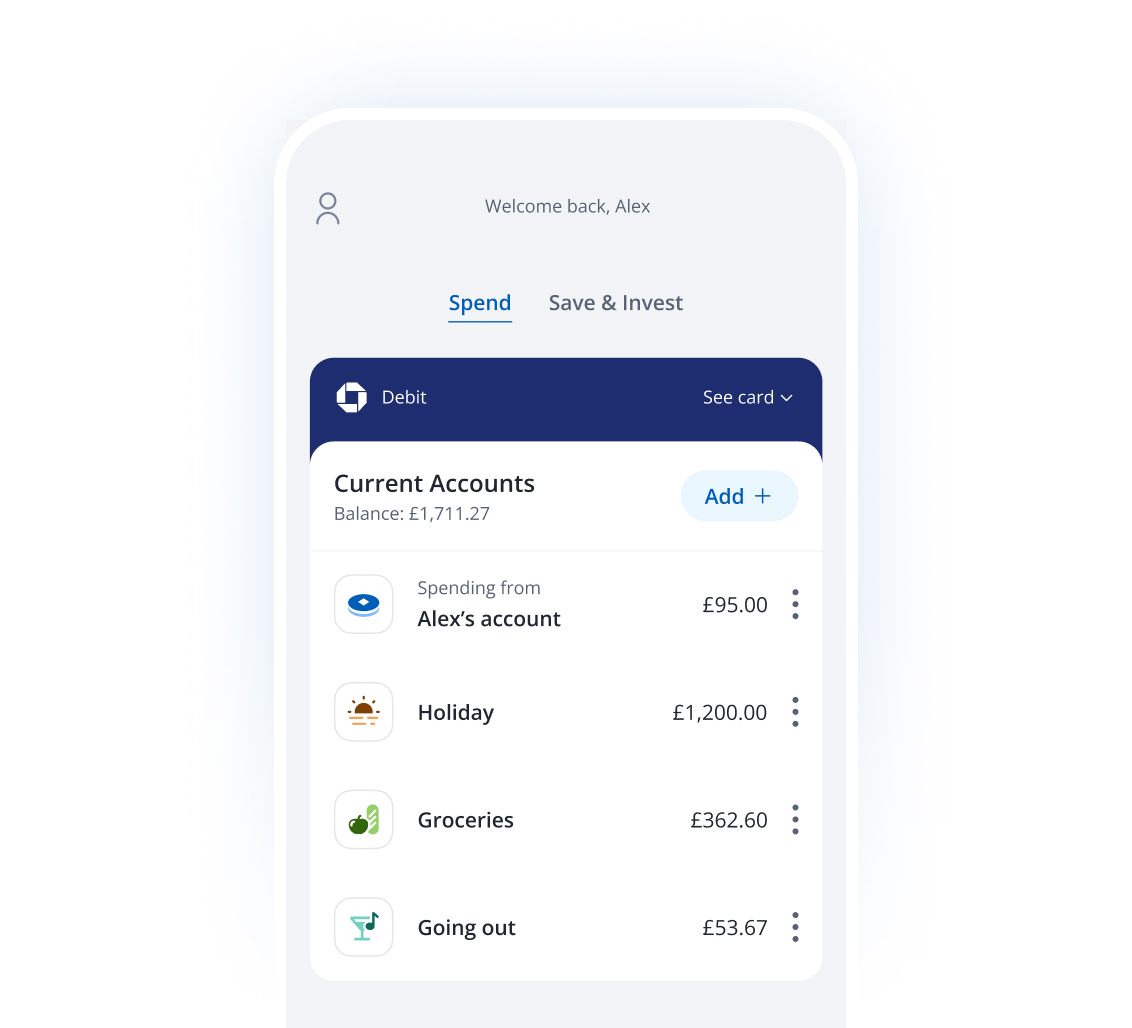

1. Current Account

- No Fees: The Chase UK current account comes with no monthly fees, making it an appealing option for everyday banking without the worry of hidden charges.

- Instant Notifications: Real-time notifications for transactions help you keep track of your spending effortlessly.

- Budgeting Tools: Chase’s app includes built-in budgeting features that categorize your spending automatically, making it easier to manage your finances.

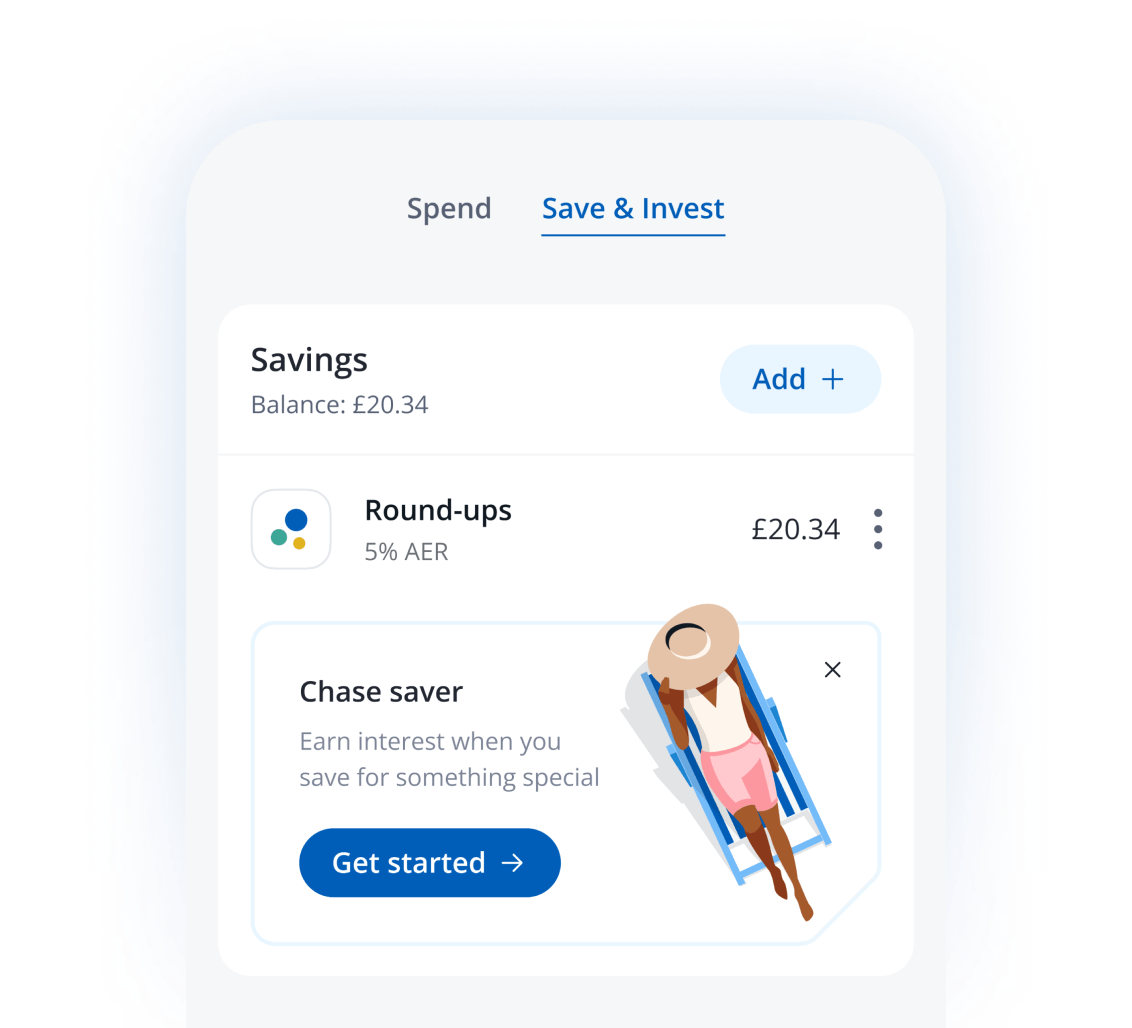

- Round-Ups: One standout feature is the ability to round up your purchases to the nearest pound, with the spare change automatically moved into a separate savings account and earning interest.

- Fee-Free Spending Abroad: There are no foreign transaction fees, making the current account ideal for frequent travelers.

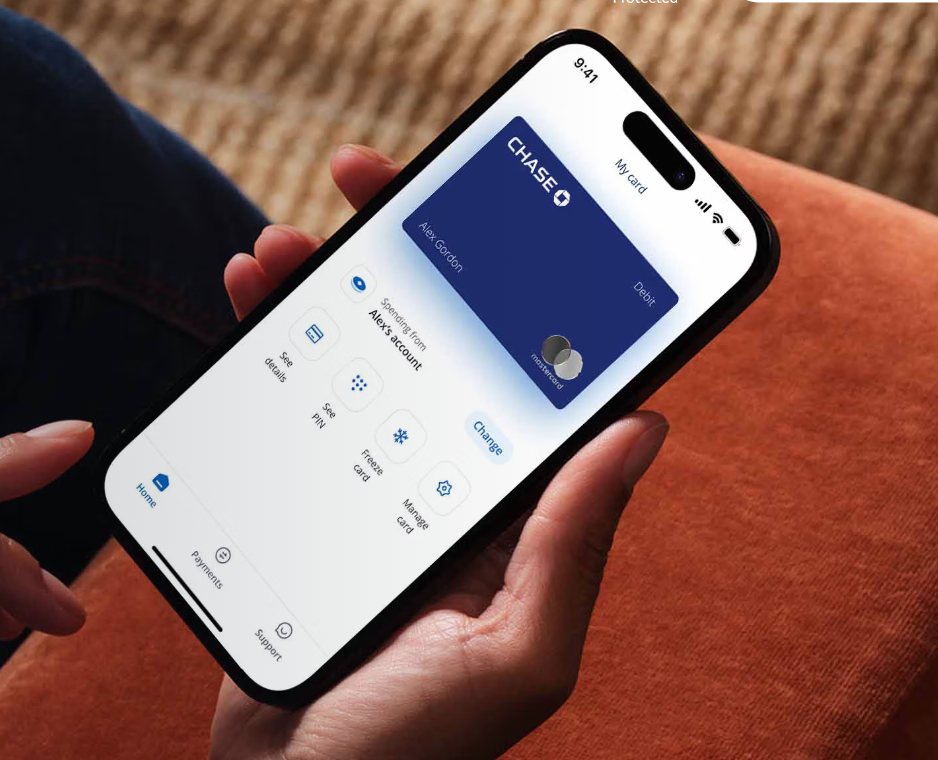

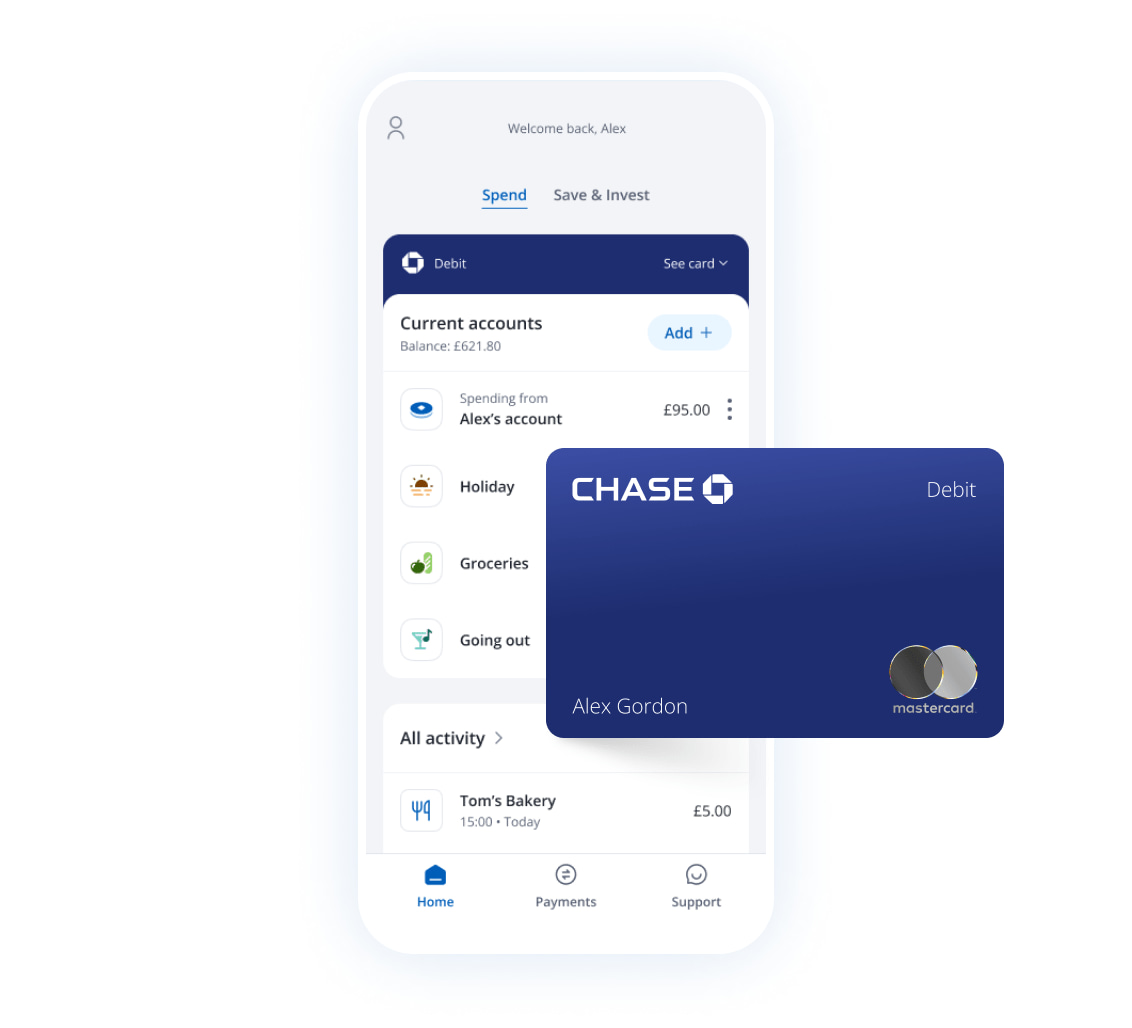

2. Chase Debit Card

- Cashback Rewards: The Chase debit card offers 1% cashback on everyday purchases for the first 12 months. This is a great way to earn while you spend, especially for those who use their card frequently.

- Customizable Card: The debit card is sleek and can be managed entirely through the app, including locking/unlocking and adjusting spending limits.

- Contactless Payments: Supports contactless payments, including compatibility with Apple Pay and Google Pay for seamless transactions.

3. Savings Account

- Competitive Interest Rate: Chase UK offers a savings account with a competitive interest rate that accrues daily and pays out monthly. This makes it a great option for growing your savings with minimal effort.

- No Minimum Deposit: There are no minimum deposit requirements, allowing you to start saving regardless of your initial amount.

- Easy Transfers: Moving money between your current and savings accounts is instant and hassle-free within the app.

Pros and Cons

Pros:

- No Fees: The absence of monthly account fees and foreign transaction fees makes Chase UK a cost-effective choice.

- Generous Cashback: Earn 1% cashback on everyday spending, making it easy to get value back from your purchases.

- User-Friendly App: The Chase UK app is intuitive, with a sleek design that makes managing your finances straightforward.

- Attractive Savings Rate: The savings account offers a competitive interest rate with no minimum deposit, making it accessible for everyone.

- Security Features: Robust security measures, including instant card lock/unlock and transaction notifications, provide peace of mind.

Cons:

- Cashback Limitations: The 1% cashback is limited to the first 12 months, which may be a drawback for those looking for long-term rewards.

- No Physical Branches: As a fully digital bank, Chase UK does not have physical branches, which may not suit customers who prefer in-person service.

- Limited Product Range: Currently, Chase UK offers basic banking products, and those seeking more complex financial products (like loans or investment options) will need to look elsewhere.

Onboarding Process

In order to open a Chase current account, you'll need the following:

✅be 18+

✅be a resident of the UK only

✅have a smartphone and a UK mobile number

✅be a tax resident of the UK

If you comply with all of the above, then the onboarding procces is pretty simple and easy, as the following:

- Easy Sign-Up: The onboarding process for Chase UK is fully digital and can be completed within minutes via the app. You’ll need to download the Chase UK app from the App Store or Google Play, provide basic personal information, and verify your identity with a photo ID.

- Identity Verification: Chase UK uses digital identity verification, requiring you to take a selfie and a photo of your ID. The process is quick, usually taking just a few minutes, and once approved, you can start using your account immediately.

- Card Delivery: Once your account is set up, your Chase debit card is sent to your address. In the meantime, you can start using your digital card via Apple Pay or Google Pay.

- Initial Funding: You can easily fund your account via bank transfer from another bank account. The app guides you through this process, making it straightforward to get started.

Who Is Chase UK For?

- Digital Savvy Users: Chase UK is ideal for tech-savvy individuals who are comfortable managing their finances through an app. Its intuitive design and user-friendly features cater well to those looking for a seamless, all-digital banking experience.

- Frequent Travelers: With no foreign transaction fees and fee-free ATM withdrawals abroad, Chase UK is a great choice for travelers. The ability to spend internationally without extra costs is a significant advantage.

- Budget-Conscious Individuals: If you’re looking to avoid banking fees while also earning rewards and interest on your savings, Chase UK provides excellent value. The cashback on everyday purchases and the competitive savings rate make it a cost-effective choice.

- Those New to Saving: Chase UK’s savings account, with its easy setup and no minimum deposit, is perfect for those new to saving. The round-ups feature helps build savings effortlessly by rounding up transactions and saving the spare change.

Regulation and Security

Chase UK operates under strict regulatory oversight, being part of JPMorgan Chase, one of the largest and most trusted financial institutions globally. It is authorized by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA in the UK. This means that Chase UK adheres to rigorous standards for customer protection, financial stability, and operational integrity.

In terms of security, Chase UK employs state-of-the-art measures to protect your account and personal information. These include robust encryption technologies, multi-factor authentication, and instant notifications for every transaction. The app allows you to instantly lock and unlock your card if lost or stolen, providing an extra layer of security. Additionally, funds held in Chase UK accounts are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000, ensuring that your money is safe even in unlikely adverse scenarios. With these comprehensive security and regulatory protections, Chase UK offers peace of mind, making it a reliable choice for your banking needs.

Final Thoughts by our experts:

Chase UK offers a strong digital banking experience with its fee-free current account, attractive cashback rewards, and competitive savings rates. The easy onboarding process and robust app make it an appealing choice for those comfortable with digital-only banking. While it may not suit customers who prefer in-person services or require a wider range of financial products, Chase UK excels in providing a modern, straightforward, and rewarding banking solution for everyday use.

"Whether you’re looking to simplify your finances, earn cashback on purchases, or grow your savings, Chase UK’s digital banking services are worth considering for your financial needs."

FAQ

Q: Is Chase UK a fully digital bank?

A: Yes, Chase UK is a fully digital bank with no physical branches. All banking services are managed through the Chase UK app, offering a seamless and convenient banking experience from your smartphone.

Q: How do I open a Chase UK account?

A: To open a Chase UK account, download the Chase UK app from the App Store or Google Play, provide your personal information, and verify your identity using a photo ID and a selfie. The process is quick and can be completed entirely online.

Q: Are there any fees associated with the Chase UK current account?

A: No, Chase UK does not charge any monthly fees for its current account. Additionally, there are no fees for spending abroad or making ATM withdrawals in supported currencies.

Q: What is the interest rate on the Chase UK savings account?

A: Chase UK offers a competitive interest rate on its savings account, which accrues daily and pays out monthly. The rate is subject to change, so it's best to check the latest rates directly on the Chase UK app or website.

Q: Can I use the Chase UK debit card abroad?

A: Yes, the Chase UK debit card can be used abroad without incurring foreign transaction fees, making it ideal for international travel. It also supports contactless payments, Apple Pay, and Google Pay.

Q: What security features does Chase UK offer?

A: Chase UK employs advanced security measures, including encryption, multi-factor authentication, and instant transaction notifications. You can also instantly lock or unlock your debit card via the app if it is lost or stolen.

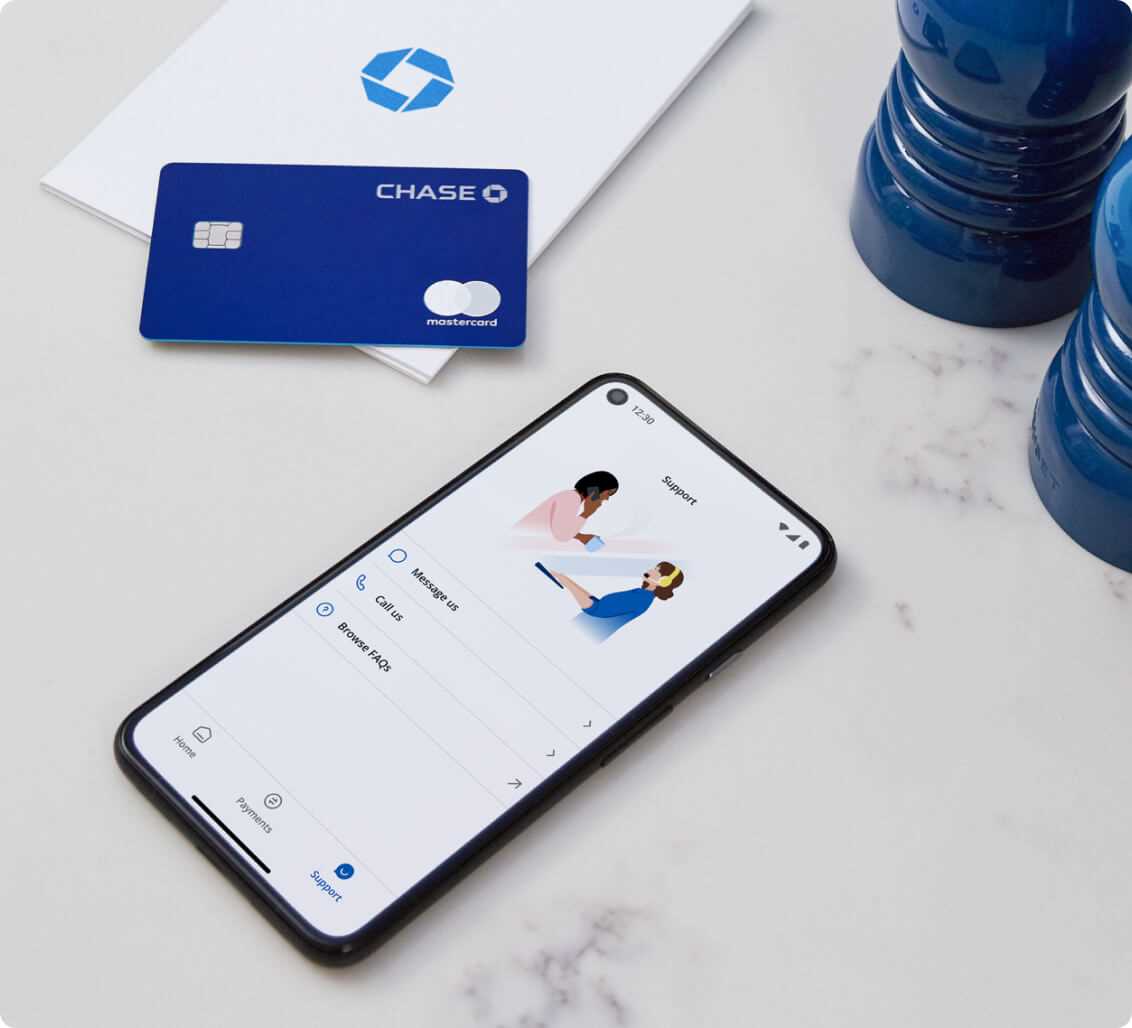

Q: Does Chase UK offer customer support?

A: Yes, Chase UK offers customer support through the app, including chat and messaging services. There is also a dedicated help section within the app that provides answers to common queries and guidance on using Chase UK services.

Q: Are funds in my Chase UK account protected?

A: Yes, funds in your Chase UK account are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 per person. This provides added peace of mind that your money is secure.

Q: How does the cashback feature work on the Chase UK debit card?

A: Chase UK offers 1% cashback on everyday purchases made with the Chase debit card for the first 12 months. Cashback is automatically credited to your account, allowing you to earn rewards effortlessly as you spend.

Q: Who is Chase UK best suited for?

A: Chase UK is ideal for digital-savvy users who prefer managing their finances through a mobile app, frequent travelers who benefit from fee-free spending abroad, and budget-conscious individuals looking to avoid bank fees while earning cashback and competitive interest rates on savings.

Chase UK

|

96

|

- Pay zero fees from us whether you are home or abroad.

- 24/7 support via app.

- Earn 3.85% AER (3.78% gross) variable on separate round up pot paid monthly.