Most Valuable Savings Accounts.

November 2025

Easy Access / Fixed Rate / Notice Accounts with the Highest Rates for The UK

| Brands | Accounts & Pricing | Card | Highlights | Our Rating | Next Step | |

|---|---|---|---|---|---|---|

| 1 |

|

|

|

|

98

More info+ |

Go To Site |

| 2 |

|

|

|

|

96

More info+ |

Go To Site |

| 3 |

|

|

|

|

92

More info+ |

Go To Site |

| 4 |

|

|

|

|

89

More info+ |

Go To Site |

| 5 |

|

|

|

|

86

More info+ |

Go To Site |

| 6 |

|

|

|

|

82

More info+ |

Go To Site |

| 7 |

|

|

|

|

79

More info+ |

Go To Site |

Chase Debit Mastercard

Chase Debit Mastercard

Provided by Raisin UK

Provided by Raisin UK

Provided by Raisin UK

Provided by Raisin UK

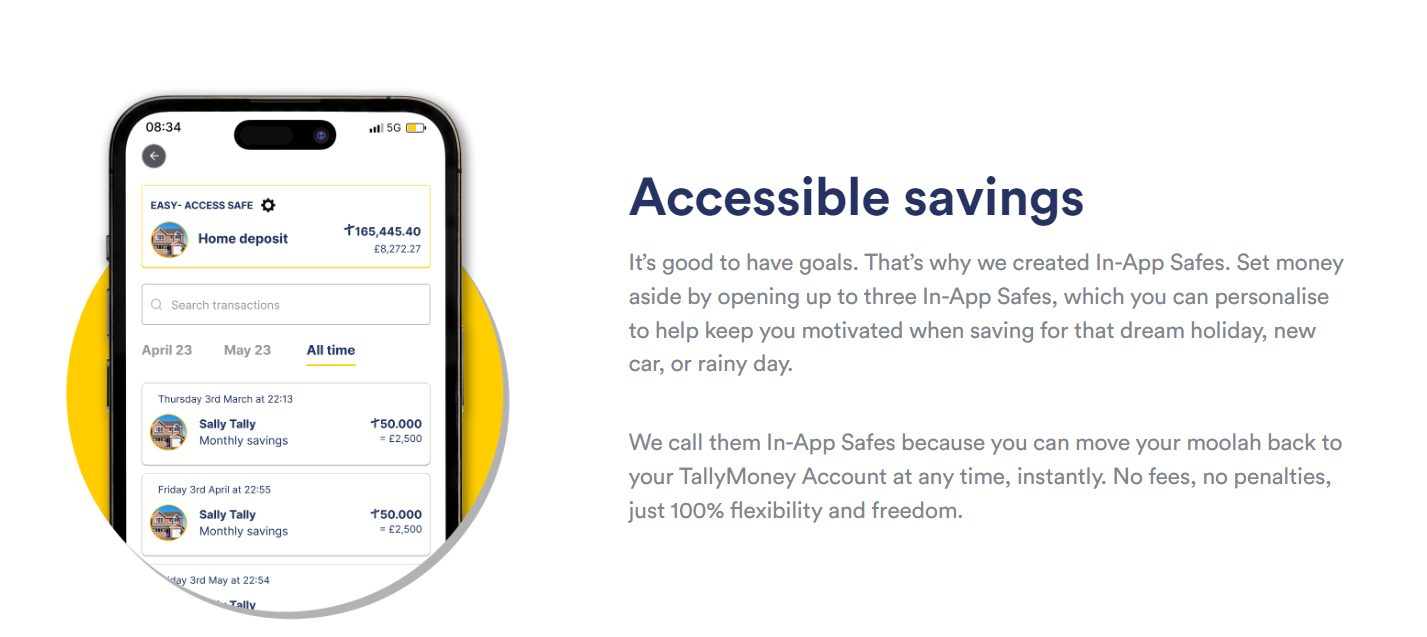

TallyMoney Debit Mastercard®

TallyMoney Debit Mastercard®

Provided by Raisin UK

Provided by Raisin UK

Provided by Raisin UK

Provided by Raisin UK

Provided by Raisin UK

Provided by Raisin UK

Understanding Savings Accounts in the UK

Savings accounts in the UK offer a safe and flexible way to grow your money. With various types available, each designed for different needs and goals, it’s important to understand how they work, what to look for, and how to choose the right one.

Types of Savings Accounts

1. Easy Access Savings Accounts

- Features: These accounts offer flexibility, allowing you to withdraw your money whenever you need it.

- Interest Rates: Typically lower than fixed-term accounts but with the benefit of accessibility.

- Ideal For: Individuals who may need to access their savings quickly without facing penalties.

2. Fixed-Rate Bonds (Fixed-Term Savings Accounts)

- Features: Fixed-rate bonds lock your money for a specified period (typically 1 to 5 years) at a fixed interest rate.

- Interest Rates: Generally higher than easy access accounts, as you’re committing your money for a longer period.

- Considerations: Early withdrawals often aren’t allowed or come with a penalty, so this option is best for funds you won’t need immediately.

- Ideal For: Those looking to secure a guaranteed return without needing regular access to their money.

3. Regular Savings Accounts

- Features: These accounts require regular monthly deposits and often limit the number of withdrawals you can make.

- Interest Rates: Tend to offer higher rates as they encourage regular saving habits.

- Ideal For: Individuals looking to save small amounts monthly, such as first-time savers or those building an emergency fund.

4. Notice Savings Accounts

- Features: Notice accounts require you to provide notice (e.g., 30, 60, or 90 days) before you can withdraw funds.

- Interest Rates: Typically higher than easy access accounts, as you’re agreeing to delay access to your money.

- Ideal For: Those who don’t need immediate access to their savings but still want some flexibility in withdrawing their funds.

5. ISA Savings Accounts (Individual Savings Accounts)

- Features: ISAs allow tax-free savings up to a certain limit each year (£20,000 in the 2023/2024 tax year).

- Types of ISAs:

- Cash ISA: A standard ISA with tax-free interest.

- Stocks & Shares ISA: Allows investment in stocks and shares, offering higher potential returns but with risk.

- Lifetime ISA (LISA): Aimed at those saving for a first home or retirement, with a government bonus of up to £1,000 annually.

- Innovative Finance ISA: Allows investing in peer-to-peer loans, carrying higher risk for potentially higher returns.

- Ideal For: Those seeking tax-free interest, especially if they’re saving larger amounts or looking for investment options within a tax-free wrapper.

What to Look for in a Savings Account

- Interest Rate

- The interest rate determines how much you’ll earn on your balance. Comparing rates is essential, but consider whether the rate is variable or fixed to understand how your earnings might change over time.

- Accessibility

- Consider how soon you may need to access your money. For short-term goals, an easy access account might be best. For longer-term savings, a fixed-rate bond or notice account could provide better returns.

- Minimum and Maximum Deposit Requirements

- Some accounts require a minimum deposit to open or limit the maximum balance. Make sure the account aligns with how much you’re able to deposit upfront or monthly.

- Withdrawal Restrictions

- Many accounts have restrictions on withdrawals or penalties for early access. Understand these terms to avoid unexpected charges or limitations.

- Tax Implications

- The Personal Savings Allowance (PSA) allows basic-rate taxpayers to earn £1,000 in interest tax-free annually (£500 for higher-rate taxpayers). ISAs, however, offer tax-free interest beyond the PSA limit.

- Fees and Penalties

- Be aware of any fees associated with the account, such as monthly maintenance fees or penalties for withdrawing early.

Important Considerations

- Inflation: High inflation can erode the purchasing power of your savings. When possible, choose an account with an interest rate that matches or exceeds inflation.

- Compound Interest: Accounts that compound interest monthly or daily offer higher returns over time compared to annual compounding.

- Rate Changes: Variable interest rates can fluctuate with the market. Fixed-rate accounts guarantee a set rate but may offer lower flexibility.

Choosing the Right Savings Account for You

Ultimately, the best savings account for you will depend on your personal financial goals, how much access you need to your funds, and your tax status. For instance, an easy access account might suit those building an emergency fund, while a fixed-rate bond could be ideal for saving toward a long-term goal like buying a home.

By comparing different types of accounts and understanding each one's features and limitations, you can make a more informed choice and maximize the potential of your savings.

The Advantages of Neobanks

Always Available

Now you can Fully manage your bank account on-the-go using the app or desktop site

Financial Control

Control your money with unique budgeting tools and real-time actions notifications

Safe & Secure

These services uses the highest level of security standards, regulations and funds protection, so your money will be safe

Stay On The Safe Side & Make Smarter Decision

All of the services presented in our website are regulated and licenced.

Top8neobanks' team of fintec experts took an in depth reviews and examinations of these services and thier products in order to give you, the customer, as much added value as possible and allowing you to make smarter and safer decision before upgrading your financial life and opening your first digital bank account with one of the many services available in the market.

If you find anything incorrect with the data presented both on our site and/or the services, please feel free to contact us via email, and we will do our best to correct it and inform others.

Thank you for choosing our service and we hope you will be satisfied from choosing to be part of the revolution of banking re-defind.